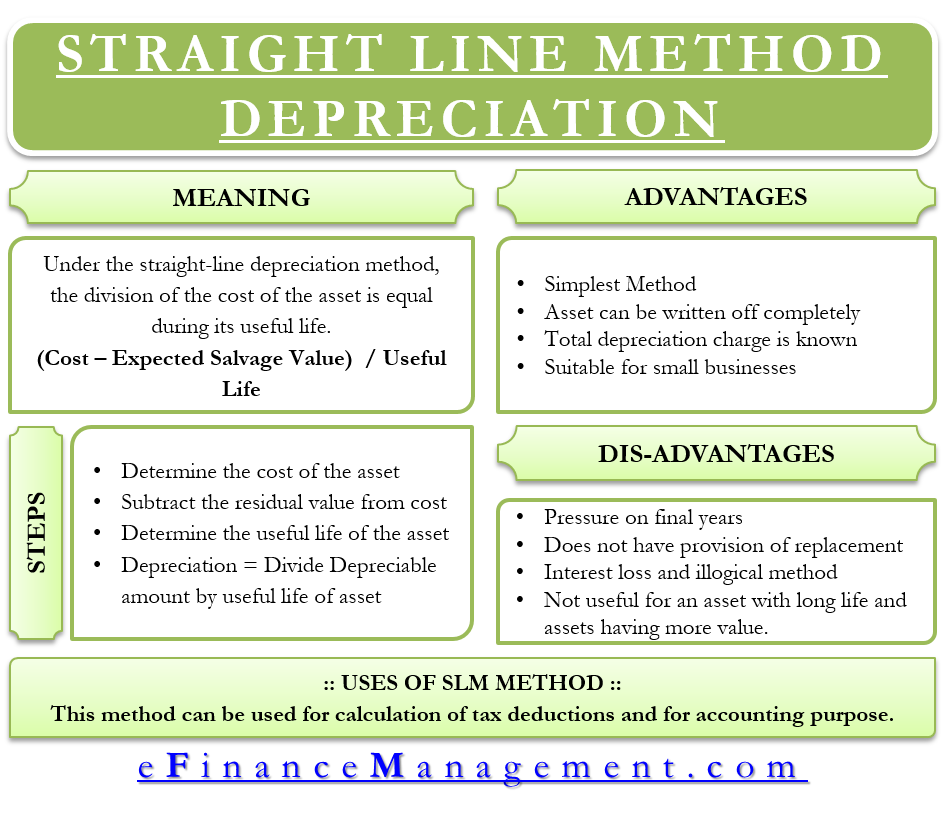

Straight-line Depreciation Method | Definition | Formula | Example | Graph | Journal Entries | Advantages and Disadvantages

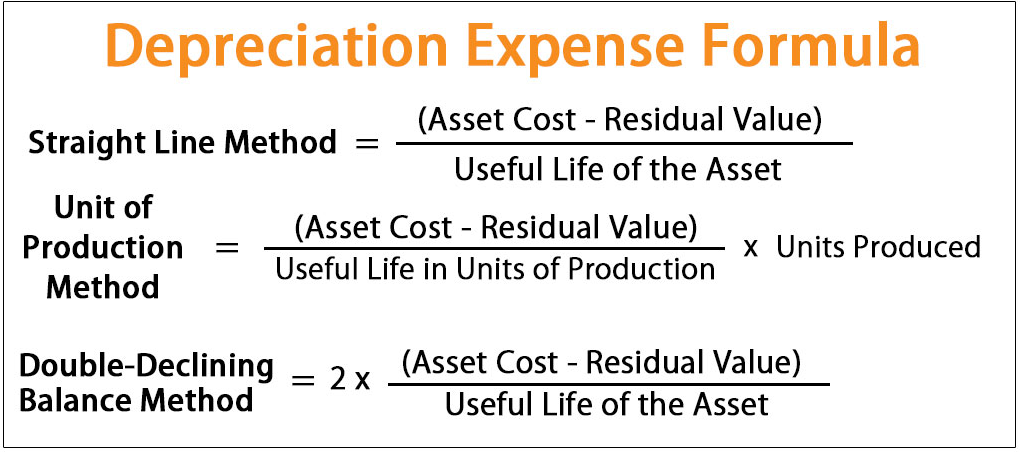

Under which method of depreciation annual depreciation charges bears a fixed % of the original depreciable value of the assets.

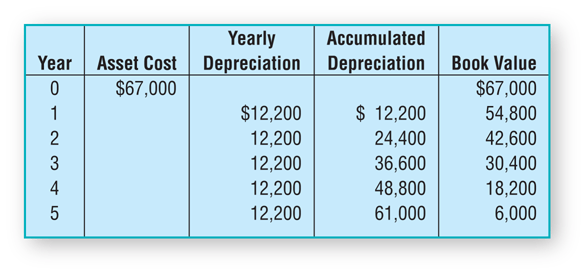

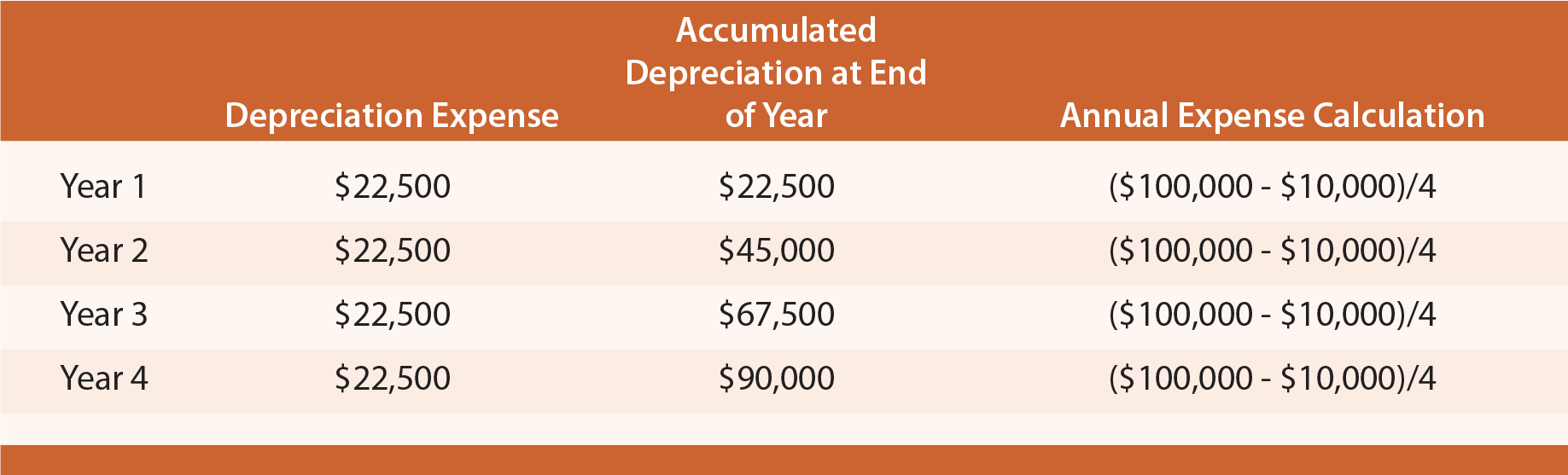

Straight line method/ Fixed instalment method / Original cost method - Example, Merits, Limitations, Example Illustration, Solution | Methods of providing depreciation | Accountancy

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)